When it comes to credit cards, the TD First Class Travel Visa Infinite is an outstanding model for travelers who want the best benefits and rewards. This card is made to improve your travel experiences and comes with a ton of benefits that are perfect for today’s world travelers.

Let’s explore the benefits and features that make this card so desirable for travelers.

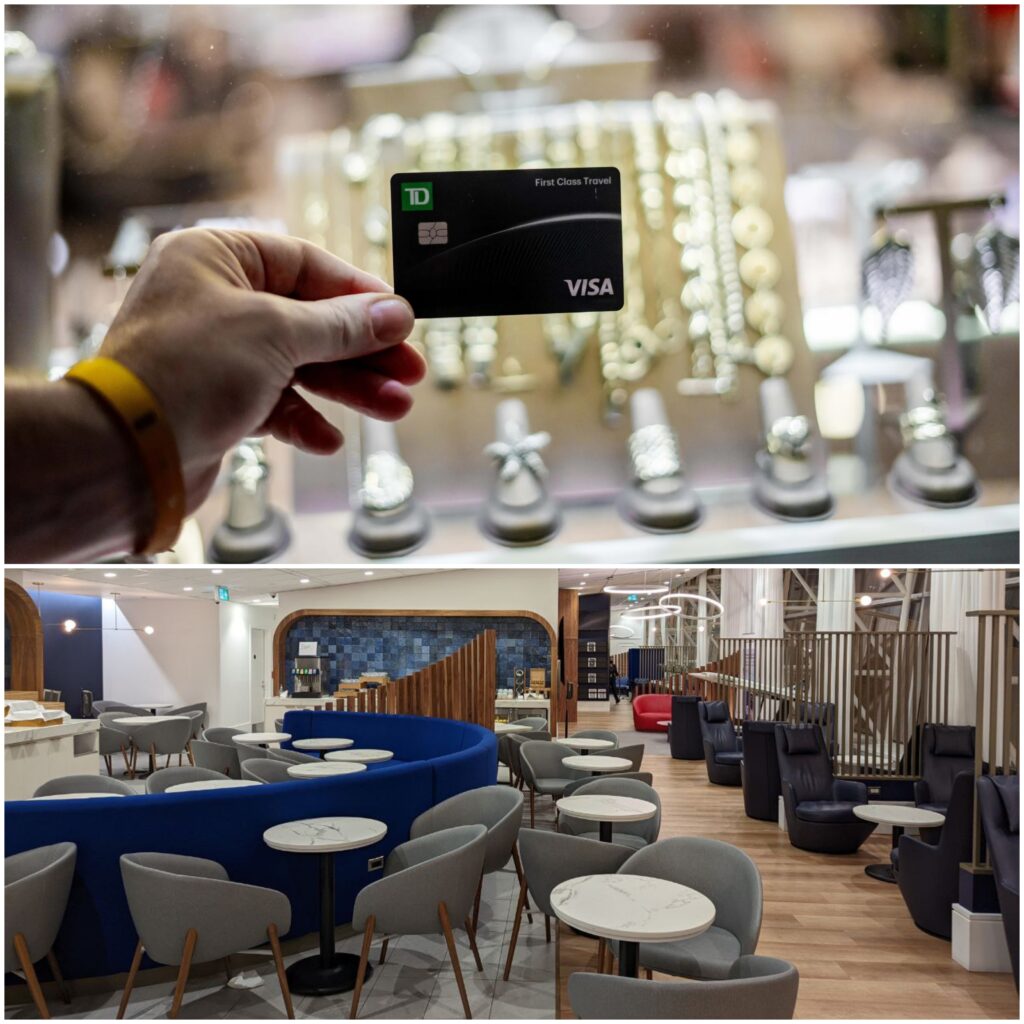

TD First Class Travel Visa Infinite Card

TD Bank offers a credit card in Canada called the TD First Class Travel Visa Infinite Card, which is designed especially for frequent travelers.

With regular purchases, you can gain points that can be redeemed for vacation benefits.

Why Choose the TD First Class Travel Visa Infinite Card?

1. Flexibility

- With this card, you can gain points for all of your regular purchases, including travel, lodging, and experiences.

2. Travel Perks

- Savor birthday bonuses, complete travel insurance, and the yearly td travel infinite visa card.

3. Sustainability

- 90% of the plastic used to make the card is recycled, proving TD’s environmental commitment.

Key Features

1. Welcome Bonus

- With your first purchase, receive 20,000 TD Rewards Points.

- After spending $5,000 within 180 days of opening an account, you can receive an extra 80,000 TD Rewards Points.

- A birthday bonus of up to 10,000 TD Rewards Points is also available.

2. Annual Fee

- The first year $139 annual fee is not charged.

- The first additional cardholder costs $50, and each additional card after that costs nothing.

3. Earning TD Rewards Points

- Earn points for regular expenses like dining out, groceries, and bill payments.

- No seat restrictions or travel blackouts use points to book lodging, travel, and other accommodations.

4. Travel Benefits

- Get a $100 TD Travel Credit every year when you use Expedia for TD to make reservations.

- Get access to a wide range of travel insurance options.

- As long as your account is active and in good standing, TD Rewards Points have no expiration date.

How Can I Apply for TD First Class Travel Visa Infinite Card?

It is easy to apply for the TD First Class Travel Visa Infinite Card.

Take these actions,

1. Eligibility Check

- Make sure your household income of $100,000 or your personal income of at least $60,000 per year meets the requirements.

- Verify that you are of legal age in your province or territory and that you reside in Canada.

2. Application Process

- To apply online, go to the TD website.

- Give the required financial and personal details.

- Wait for approval; this usually happens within a few working days.

3. Documentation

- During the application process, you will be required to submit identification documents, proof of income, and other relevant data.

- Before applying, be sure to read the terms and conditions of platinum travel visa td too.

Application Form – CLICK HERE

Is There a Grace Period for Payments?

Yes, there is a grace period for payments on the TD First Class Travel Visa Infinite Card.

This indicates that there is a window of opportunity for you to pay off your balance in full without being charged interest.

This is an explanation,

- Minimum 21 Days

After your statement closing date, you will have at least 21 days to settle the outstanding balance on your statement.

This is the typical grace period that TD offers for credit cards.

- Potential Extension

In certain circumstances, the grace period may last longer than the customary 21 days.

For instance, the grace period for your subsequent statement may be shortened if you fail to make the entire payment by the deadline.

- Must to Remember

You have a grace period, but after the due date, interest will be charged on any amount that remains unpaid.

You must pay the entire balance on your statement by the due date in order to avoid paying interest.

It is usually best to consult your most recent TD credit card statement or get in touch with TD directly for clarification if you want the most accurate information about your particular grace period.

Read: Schengen Visa Insurance – A Comprehensive Guide for Travelers

How Do I Earn TD Rewards Points?

Depending on the TD Credit Card you own, there are several ways to earn TD Rewards Points. The following are some methods for earning TD Rewards Points,

1. Everyday Purchases

- TD Rewards Visa Card: Gain points for regular purchases. As long as your account is active and in good standing, your points are never lost.

- TD First Class Travel Visa Infinite Card: Get a $100 TD Travel Credit each year by earning points on regular purchases.

2. Sign-Up Bonuses

You might be eligible for a welcome bonus of TD Rewards Points when you first obtain a TD Rewards Credit Card.

With the TD First Class Travel Visa Infinite Card, for scenario, you can earn 20,000 points as a welcome bonus on your first purchase and an extra 80,000 points after spending $5,000 within 180 days of opening an account.

3. Promotions

Look out for exclusive offers that provide bonus points for particular spending categories or during promotional times.

4. Recurring Bill Payments

In this case, you can earn two TD Rewards Points for every $1 charged to your account for eligible bill payments.

To increase your point total, set up regularly scheduled recurring bill payments on your account.

To make the most of your TD Rewards Points, do not neglect to review the full terms and conditions of your TD Credit Card.

How do I redeem TD Rewards Points?

It is simple to redeem your TD Rewards Points.

This is how it works,

1. Log In

- Go to the TD Rewards website, and then sign in with your credentials.

2. Browse Rewards

Look at the redemption choices that are available, including,

- Travel: Reserve lodging, transportation, hotels, and more.

- Merchandise: Select from several products.

- Gift Cards: Exchange points for well-known retailers’ gift cards.

- Cash Back: On your statement, convert points to cash back.

- Select and Redeem

Choose your favorite reward category after you have made up your mind.

To finish your redemption, follow the instructions.

TD Rewards Login – CLICK HERE

Keep in mind that the redemption option you choose may affect the value of your points. For all the information and the most recent deals, visit the TD Rewards website.

TD First Class Travel Visa Infinite Card Foreign Transaction Fee

When using the TD First Class Travel Visa Infinite Card to make purchases outside of Canada, there is a 2.5% foreign transaction fee.

This implies that there will be a 2.5% fee added to the exchange rate each time you use your card to make a purchase in a foreign currency.

This fee has the potential to greatly decrease your rewards earnings if you travel abroad frequently.

Look into other travel cards that either offer no foreign transaction fees or waive them for a certain amount of time if you plan to make a lot of foreign transactions while traveling.

You might be able to earn points and save money on travel by doing this.

Read: Who is eligible for business visa in Canada?

TD First Class Travel Visa Infinite Lounge Access

One thing that is commonly brought up in negative reviews is the lack of free airport lounge access with the TD First Class Travel Visa Infinite Card.

For travelers who value the conveniences and comforts of airport lounges, this could be a drawback.

Here are some additional methods for using this card to enter airport lounges,

- Independent Lounge Memberships

Look at programs for purchasing lounge memberships, like the Plaza Premium or Priority Pass. Access to a global network of airport lounges is made possible by these programs.

Regardless of the credit card you use, you can enroll in these programs independently and pay the membership fee to gain access to the lounge.

- Benefits of Other Cards

Several credit cards may come with free lounge access programs as part of their benefits if you carry more than one.

Check your current travel cards to see if access to lounges is included. In this manner, you can optimize your travel benefits by utilizing the advantages of various cards.

- Airline Status Perks

Some airlines offer free lounge access to customers traveling in first class or business class, or to those with high frequent flyer status, though this is not always the case.

To qualify for these benefits, you may need to spend a lot of money on the particular airline or fly with them a lot to earn a lot of miles.

Since this approach might not be practical for everyone, it is something to think about if you regularly travel with a specific airline.

TD First Class Travel Visa Infinite Review

- Pros

1. High rewards rate for travel

For every dollar spent, you receive at least two points; for trips booked through Expedia for TD, you receive 9 points.

This corresponds to a potential travel cash-back rate of 4.5%, among the highest available rates on Canadian travel cards.

2. Flexible redemption options

One can use their TD Rewards points to book flights, hotels, and rental cars, among other travel-related expenses.

They can also be redeemed for cash back or statement credits.

3. Travel insurance

The card includes a full travel insurance package that covers medical expenses, lost luggage, and delayed flights.

4. Welcome bonus and annual fee

If you have a qualifying TD bank account, you can waive the annual fee and typically receive a large welcome bonus with this card.

- Cons

1. Limited flexibility for booking travel

You must use Expedia for TD when making your travel reservations to receive the best rewards rate.

This might not be the best option if you would rather make your reservations directly with hotels, airlines, or other travel agencies.

2. Lower rewards rate for non-travel

When it comes to non-travel purchases, you only get 2 points per dollar, which is less than some other cards.

For more td first class travel visa infinite review – CLICK HERE

For frequent travelers who feel comfortable using Expedia for TD, the TD First Class Travel Visa Infinite card is a solid choice overall.

Read: Can I get a job in Canada without work visa?

Frequently Asked Questions

1. Is TD First Class Travel Visa Infinite card good?

Ans: It all depends on your travel preferences and habits whether or not the TD First Class Travel Visa Infinite card is a good option.

2. Is Visa Infinite better than Platinum?

Ans: Consider Visa Infinite as a luxurious, first-class travel experience complete with first-rate amenities and services. Similar to business class, Visa Platinum provides convenient, comfortable travel along with a few extra benefits.

3. Is visa infinite for rich people?

Ans: Visa Infinite cards are undoubtedly promoted for people who earn more money and who take large trips.

4. Is Visa Infinite a black card?

Ans: Since many Visa Infinite credit cards are black, the Visa Infinite card itself is not.

5. What is the minimum income for visa infinite?

Ans: Visa Infinite cards normally have minimum income requirements of $100,000 for households and $60,000 for individuals.

Bottom Line

More than just a credit card, the TD First Class Travel Visa Infinite card opens doors to unmatched travel experiences.

This card meets the separating needs of modern travelers with its attractive rewards, wide insurance coverage, and diverse range of exclusive perks.

Take your trip to new heights with the TD First Class Travel Visa Infinite, whether you are going on a weekend trip or a global exploration.

2 thoughts on “TD First Class Travel Visa Infinite Card: Take Flight with Rewards”